Contents

Displays different trading activity performance metrics of a specified security, such as Volume, Chg Up, Chg Down, Value, Delta AVAT, 52Wk Highs and 52Wk Lows. Monitor U.S. municipal bond market offerings, bids wanted, and reported transactions in one place. Shows when markets are open/closed and when they are operating on a partial day schedule. Displays a list of current and historical credit ratings for up to 10,000 issuers, allowing to track upgrades, downgrades, and other moves that reflect the issuer’s fiscal strength and degree of risk. Shows stocks that drive the movement of a selected index or other equity group.

The famous black-screen terminal has become nearly synonymous with Wall Street. Bloomberg is at the forefront of disseminating data across the world. Any company worth its salt has at least a couple of Bloomberg Terminals in its offices. The Terminal has real-time data flowing in from every major market in the world, breaking news, in-depth research, data, analytics, and communication to enable its users to make decisions.

Refinitiv Eikon Cost

We leverage the world’s most sophisticated data sets to create clear perspectives that help corporate strategy, finance and policy professionals in India to navigate change and generate opportunities. Meanwhile, as the Indian government increases issuance of debt to fuel the growing economy, the easing of controls on foreign investment is set to open new avenues for trading and capital flows. This, and India’s future inclusion in benchmark indices, will be instrumental in cultivating the local bond market. The Terminal provides coverage of markets, industries, companies & securities across all asset classes.

But, if you’re looking for a platform that is powerful, customizable, and offers a breadth of data, then Koyfin might be the right fit. If you’re on the fence about whether or not to give Koyfin a try, you may want to note that this platform is free to all users. Even though there are plans in the works to release a paid service that will offer additional data, functionality, market coverage, and customization, Koyfin will continue to offer a free version. We connect India’s financial institutions and investors to international opportunity.

- While Bloomberg Terminal and Thomson Reuters Eikon are by far the two most popular platforms in this space, there are several less expensive substitutes.

- History includes cash dividends and other distributions, such as stock splits.

- To many investors, financial tools provided by Bloomberg and Reuters have been indispensable in helping them post rich returns and prosper during the bull market of the last decade.

- This, and India’s future inclusion in benchmark indices, will be instrumental in cultivating the local bond market.

- That price, however, increased proportionally with the single-terminal price over the past decade.

Everything you would want to know about any stock is incorporated into its reports. Even better, all information is displayed in a clear, structured way so you can do comprehensive research on any company. Take a look below to see how Bloomberg Terminal’s alternatives measure up. They are always behind their tech teams, asking them to make better use of data and content. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

With access to high-quality data, a user-friendly platform, and top trending financial news, it’s an excellent option for those who aren’t ready or able to invest thousands of dollars. Koyfin is an investment analytics platform that was founded in 2016 by former Wall Street traders. The goal was to create a reliable alternative to the high-priced professional platforms on the market. The Bloomberg Terminal revolutionized an industry by bringing transparency to financial markets. You can trust Ziggma to deliver professional-grade financial data as its founders have decades of experience working for global asset managers. A Bloomberg Terminal means you join a global community of more than 325,000 of the world’s most influential financial professionals.

Bloomberg Functions

The city pays the standard rate for a single subscription to the terminal, officially known as Bloomberg Professional, including Bloomberg Anywhere access, which allows the customer to log in from other devices. GP and its related charts and study functions are visual time series analysis bloomberg terminal cost india tools used to put financial data into context. All four attempt to offer a one-stop-shop platform that provides all types of financial data services (with a massive price tag, as you’ll see below). According to the Bloomberg website, there are 325,000 users of the Bloomberg terminal.

When you see exceptionally motivated people on this road you can’t help yourself from jumping in. The team at OpenBB are on to something special and I am fortunate that I can help shape their GTM thinking. It will no doubt open up one of the most conservative industries in the world and has the potential to bridge retail and institutional investors through open source.

The Bloomberg Terminal enables businesses in India to better understand the world and maximise success.

Instead, investment bankers are far more likely to have their own dedicated FactSet or Capital IQ subscription. FactSet offers many of the same features for about $8,000 less per year and enjoys a 95% satisfaction rate from its customers, making it our top pick as the best alternative. For those who still find FactSet’s $12,000 price tag daunting, other companies like Koyfin offer a great free option to those who want the support of a terminal without breaking their budget. Eikon offers its user access to cross-asset calculators, portfolio analytics, and StarMine quantitative analytics and models, which is why it stands out as the best terminal for financial data and analytics. FactSet has been helping its financial clients since the late 1970s and has 37 offices in 20 countries and serves over 162,000 financial professionals. With the FactSet platform, users are able to stay on top of market trends, monitor portfolio risk and performance, and even execute trades.

They have a dashboard and charting tools covering equities, company financials, analyst estimates, valuation, ETFs, Mutual Funds, FX, bond yields, economic data and news/Twitter. Knowledge is power, as the famous saying goes, and few places are more evident than in the world of investing. Since 1982, Bloomberg Terminal has been a beacon of light guiding investors by providing news, data, in-depth research and a unique suite of trading tools to traders’ desktops. These two companies are best known as rivaling the traditional outlets such as The Wall Street Journal, The New York Times, and The Financial Times for financial news.

The Best Bloomberg Terminal Alternatives:

Symphony was created to solve data security and compliance and facilitate real-time communication. You can get all of the up-to-date information you need in a safe environment. Symphony uses end-to-end encryption to protect all of your communications and they use bots and automation to improve everyday workflows. It’s not cheap, but with a history of stellar customer service as well as top-notch data and analytics, you might determine that it is worth the money. No matter the location, pricing transparency is crucial to attract investment and develop a robust capital market system. Bloomberg helps enhance capital market pricing transparency in India, giving equity and debt markets the strength and reliability they need to grow from an environment of opacity – into one of opportunity.

If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for 65 € per month. You may want to screenshot critical data for comparison at a later time. Plus, anyone who reads the news can compare what they have seen with real-time data. You don’t have to take what you read at face value, especially because the markets are so volatile.

Find an Alternative to Bloomberg Terminal

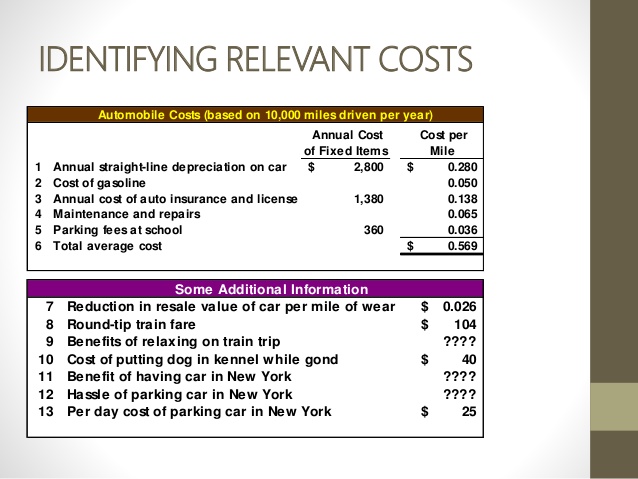

Fixed income electronic trading platform for U.S. rates and a broad set of global sovereign debt. Provides current interest rate swap rates, along with government, agency, index, LIBOR, and futures markets rates, plus economic statistics. Here we have compiled a list of what we believe are the most common and important functions, keystrokes, and shortcuts to know on the Bloomberg Terminal, inside out. Bloomberg functions mastery is key to becoming a great financial analyst. Please compare them from the perspective of sell-side equity research professionals. Interesting overview, just a quick note on FactSet, FactSet does nowadays offer access to its applications through a weblink and a mobile app.

The BVAL AAA Callable Curve is a standard market scale with non-call yields up to year 10 and callable yields thereafter. The BVAL AAA Baseline Curve normalizes callable bonds using BVAL’s expected redemption date and is used for BVAL pricing. Bloomberg valuations are supported by the BVAL Score, a proprietary measure showing the relative amount and consistency of market data used to generate each evaluated price. The most common professions to use this data provider are investment banking, equity research, and sales & trading. Gives an overview of currency rates in real time, also provides information on pricing hours for better monitoring. WPE World P/EAllows you monitor and analyze key fundamental ratios, such as price/earnings, across major equity indices and compare intra-day index level ratios against analyst estimates and other regions.

Both companies are known for their robust multimedia platforms, with key offerings being the Bloomberg Terminal and the Refinitiv Eikon, , as explained below. Market data inputs validated by financial engineers employing best-in-class and market-consistent techniques for outliers filtering, data aggregation, curve stripping and volatility modeling. Allows for calculation of the total return for a security over a specified period of time, using criteria such as price at horizon, commissions, and reinvestment rate. Allows comparing of returns of a selected security for up to five other selected securities, including its benchmark index and industry group .

Refinitiv became part of the London Stock Exchange Group , further expanding Refinitiv’s capacity to impact the financial community. FactSet must be doing something right because they have maintained a 90% customer retention rate over the last decade. However, becoming one of FactSet’s happy customers will https://1investing.in/ cost you, though it isn’t as pricey as its top competitors . Terminal pricing is not included on the FactSet website, however, an article in Wall Street Prep reports that an annual membership will cost you $12,000. Read on to see the results of our chosen list of the best Bloomberg terminal alternatives.